Navigating the Path Ahead: Mortgage Rate Projections for the Rest of 2025

Buying a home or considering a refinance is always a significant decision, and understanding the potential direction of mortgage rates is a key piece of the puzzle. As of mid-April 2025, the landscape remains dynamic, but leading housing authorities are offering their expert forecasts for the coming quarters.

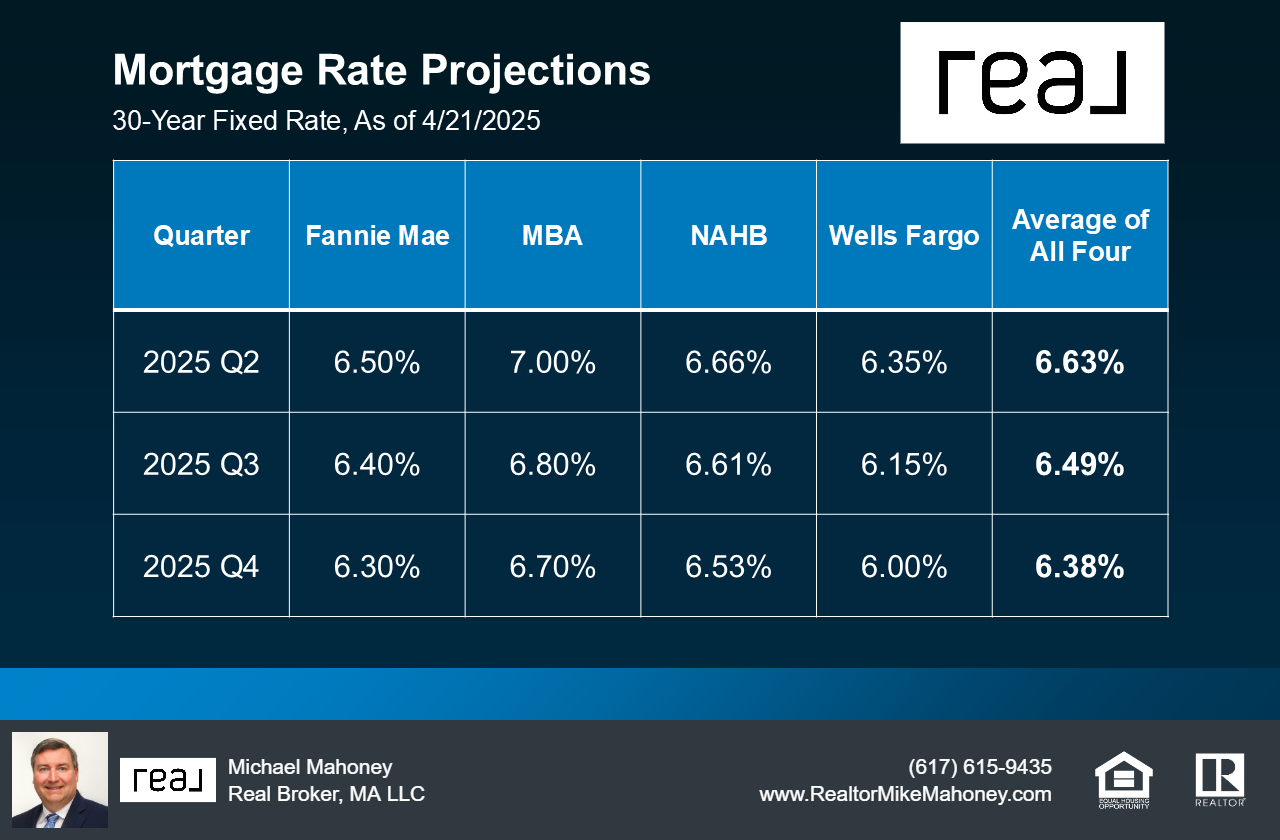

Based on data compiled on April 21, 2025, we can see projections for the 30-year fixed mortgage rate from four major industry players: Fannie Mae, the Mortgage Bankers Association (MBA), the National Association of Home Builders (NAHB), and Wells Fargo.

What the Experts Are Predicting:

Here’s a look at the average forecast across these institutions for the remaining quarters of 2025:

- Q2 2025: The average projected rate sits at . Forecasts range from Wells Fargo’s to the MBA’s .

- Q3 2025: A slight easing is anticipated, with the average projection dipping to . Individual forecasts range from (Wells Fargo) to (MBA).

- Q4 2025: The trend continues downward, with an average forecast of . Projections span from (Wells Fargo) to (MBA).

(Data summarized from Fannie Mae, MBA, NAHB, Wells Fargo as of 4/21/2025. Individual forecasts vary.)

Key Takeaway: A Trend Towards Modest Easing

The consistent theme across these projections is an expectation of a gradual, modest decline in 30-year fixed mortgage rates as 2025 progresses. While the MBA projects rates staying slightly higher, even their forecast shows a downward trend through the year. Wells Fargo offers the most optimistic outlook with rates potentially dipping to by year-end.

Why the Different Numbers?

Each organization uses complex economic models that weigh various factors differently. These include:

- Inflation expectations: How quickly inflation is expected to return to target levels.

- Federal Reserve Policy: Anticipated actions regarding benchmark interest rates.

- Economic Growth: Projections for GDP growth and the labor market.

- Bond Market Dynamics: Conditions in the market for mortgage-backed securities and Treasury yields.

- Housing Market Conditions: Supply and demand dynamics within the real estate sector itself.

For instance, Fannie Mae’s April 2025 commentary anticipates gradual improvement but notes risks remain. The MBA often provides detailed analysis of origination volumes alongside their rate forecasts. The NAHB incorporates builder sentiment and housing start data, while Wells Fargo provides insights heavily influenced by financial market conditions.

What Does This Mean for You?

- Potential Buyers: While rates around the mid-6% range are higher than the lows of recent years, the projected downward trend could offer some relief later in the year. However, waiting solely for lower rates is a gamble, as home prices could change, and personal financial situations are paramount.

- Homeowners Considering Refinancing: If rates follow these projections and dip further into the low 6% range by year-end, refinancing opportunities might become more attractive for those with higher existing rates.

Important Considerations:

Remember, these are projections, not guarantees. The economy can be influenced by unforeseen events. While the consensus points towards a slight easing of rates, the exact path remains uncertain.

Making informed decisions requires personalized advice. Discussing your specific financial situation, goals, and the current market conditions with a trusted mortgage professional and a knowledgeable real estate advisor is crucial.

Thinking about making a move in the Massachusetts market? Let’s connect to discuss how these trends might impact your plans.

Disclaimer: This blog post is for informational purposes only and does not constitute financial advice. Consult with qualified professionals before making any financial decisions.

Michael Mahoney

617-615-9435

mike@mmahoney.com

www.HomesinBostonMass.com

10 Common Street #645

Walpole, MA 02081

MA. License #9051300

Real Broker LLC License #423031

☎️ 📆 Schedule a Call with Mike Now

Linkedin Profile | Resume | Brochure | Client Testimonials | Facebook Page Twitter Youtube Instagram

See all the Properties in Greater Boston @ www.HomesinBostonMass.com

- Who: Michael Mahoney, full-time Realtor.

- Where: Greater Boston (Norfolk & Suffolk Counties).

- Experience: 20+ years in home ownership, wealth building & investment.

- Mission: Help clients achieve life goals through real estate.

- Clients: All price points; strong repeat & referral business.

I work in all price points. The majority of my business is repeat clients and the referral of clients from all over Eastern Massachusetts.

I view my role as the advisor who helps people go from the life they have to the life they dream about. I help people go from the “what if” to the “what is”

- Broad Expertise: Sold hundreds of properties – mobile homes to estates, multi-families, condos.

- Specialty: “From section eights to great estates” – no residential property too small or large.

- Area Served: Primarily Norfolk & Suffolk; also Plymouth, Bristol, Middlesex counties.

- Client Commitment: 7-day/week availability, backed by expert market research for targeted results.

- Value: Decades of diverse sales provide invaluable situational awareness for clients.

Service of My Service Areas Include: