The Truth About Down Payments

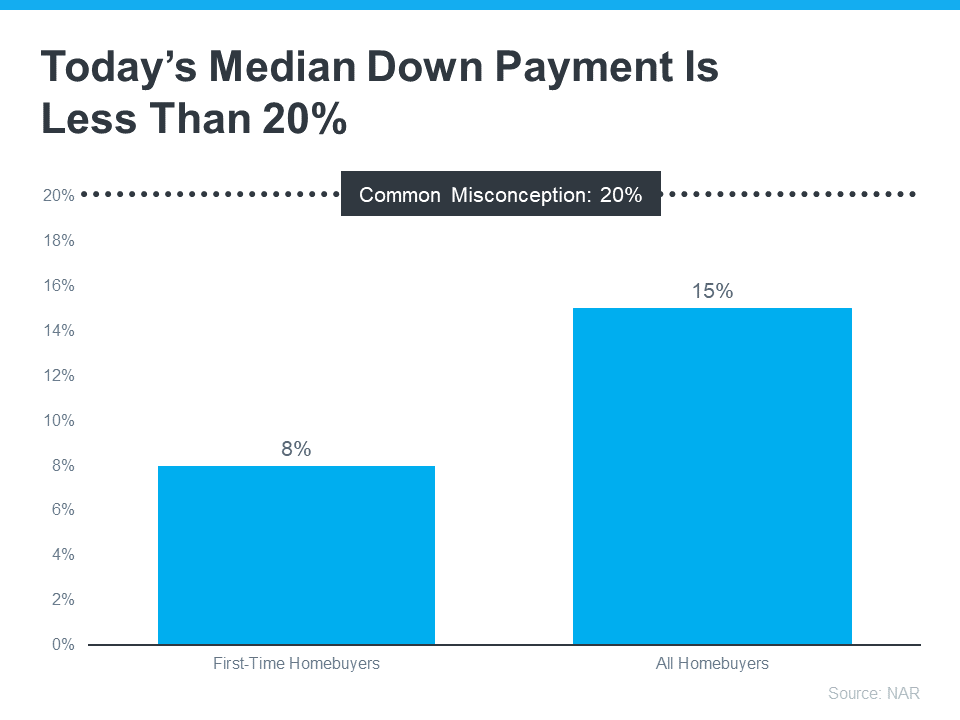

If you’re planning to buy your first home, saving up for all the costs involved can feel daunting, especially when it comes to the down payment. That might be because you’ve heard you need to save 20% of the home’s price to put down. Well, that isn’t necessarily the case.

Unless specified by your loan type or lender, it’s typically not required to put 20% down. That means you could be closer to your homebuying dream than you realize.

As The Mortgage Reports says:

“Although putting down 20% to avoid mortgage insurance is wise if affordable, it’s a myth that this is always necessary. In fact, most people opt for a much lower down payment.”

According to the National Association of Realtors (NAR), the median down payment hasn’t been over 20% since 2005. In fact, for all homebuyers today it’s only 15%. And it’s even lower for first-time homebuyers at just 8% (see graph below):

The big takeaway? You may not need to save as much as you originally thought.

Learn About Resources That Can Help You Toward Your Goal

According to Down Payment Resource, there are also over 2,000 homebuyer assistance programs in the U.S., and many of them are intended to help with down payments.

Plus, there are loan options that can help too. For example, FHA loans offer down payments as low as 3.5%, while VA and USDA loans have no down payment requirements for qualified applicants.

With so many resources available to help with your down payment, the best way to find what you qualify for is by consulting with your loan officer or broker. They know about local grants and loan programs that may help you out.

Don’t let the misconception that you have to have 20% saved up hold you back. If you’re ready to become a homeowner, lean on the professionals to find resources that can help you make your dreams a reality. If you put your plans on hold until you’ve saved up 20%, it may actually cost you in the long run. According to U.S. Bank:

“. . . there are plenty of reasons why it might not be possible. For some, waiting to save up 20% for a down payment may “cost” too much time. While you’re saving for your down payment and paying rent, the price of your future home may go up.”

Home prices are expected to keep appreciating over the next 5 years – meaning your future home will likely go up in price the longer you wait. If you’re able to use these resources to buy now, that future price growth will help you build equity, rather than cost you more.

Related Articles on Home Purchase Deposits:

Bankrate: How Much Deposit do You Need

Consumer Finance Protection Bureau: How to Decide on a Deposit Amount?

Some Lenders I trust to Help You Decide on the Best Mortgage Options:

Thea Simolari: Movement Mortgage

Harry Brousaides: Northstar Mortgage

Jason Evans: Guaranteed Rate

Rick Masnyck: Network Funding

Kathy Gervais: Citizens Bank

Bottom Line

Keep in mind that you don’t always need a 20% down payment to buy a home. If you’re looking to make a move this year, let’s connect to start the conversation about your homebuying goals.

Michael Mahoney

617-615-9435

mike@mmahoney.com

MA. License #9051300

Real Broker LLC License #423031

Linkedin Profile | Resume | Brochure | Client Testimonials | Facebook Page Twitter Youtube Instagram

See all the Properties in Greater Boston @ www.HomesinBostonMass.com

I am Michael Mahoney, a full time Realtor in Greater Boston focused on Norfolk & Suffolk Counties. I have been helping people fulfill the “American Dream” through home ownership, real estate wealth building, and real estate investment for over 2 decades.

I am Michael Mahoney, a full time Realtor in Greater Boston focused on Norfolk & Suffolk Counties. I have been helping people fulfill the “American Dream” through home ownership, real estate wealth building, and real estate investment for over 2 decades.

My goal is to help people “go from the life they have to the life they dream about” using real estate as means to build wealth and financial security. If you want to make a change, I help people go from the “what if” to the “what is”.

I work in all price points. The majority of my business is repeat clients and the referral of clients from all over Eastern Massachusetts.

I view my role as the advisor who helps people go from the life they have to the life they dream about. I help people go from the “what if” to the “what is”

I have sold everything from mobile homes to amazing estates. I have sold hundreds of homes, multi families and condos in almost every town in Suffolk and Norfolk County. I also sell homes in Plymouth, Bristol and Middlesex Counties. When asked what my specialty is, I often joke and say “from section eights to great estates”.

There is no property too small or too large in the residential space that I would shy away from.

All of my personal sales and marketing endeavors are supported by top-of-the-line personal market research completed carefully with expertise in order to create strategically targeted marketing collateral and campaigns for clients. I personally have a stand by commitment of 7-days a week for my clients. I aim to cultivate my own reputation for quality, professionalism and your results.

From selling hundreds of homes in Greater Boston comes experience and situational awareness that can only be developed over time which is a tremendous value to clients.

Schedule a Call with Mike Now

Schedule a Call with Mike Now