“Real Estate Can Make Dumb People Look Smart”

Although rates have climbed for 6 consecutive weeks, real estate has always been a sound investment. Watch my video below to see the trendline followed by a home in Greater Boston purchased in June 2014. The wealth it created for the owner is incredible.

Paying yourself first by owning your home is a tried and true way to create generational wealth.

While watching the stock market recently may have started to feel pretty challenging, checking the value of your home should come as welcome relief in this volatile time. If you’re a homeowner, your net worth got a big boost over the past few years thanks to rising home prices. And that increase in your wealth came in the form of home equity. Here’s how it works.

Equity is the current value of your home minus what you owe on the loan. Because there was a significant imbalance between the number of homes available for sale and the number of buyers looking to make a purchase over the past few years, home prices appreciated substantially. And while rising inventory and mortgage rates have cooled the market some in recent months, home prices nationally remain strong.

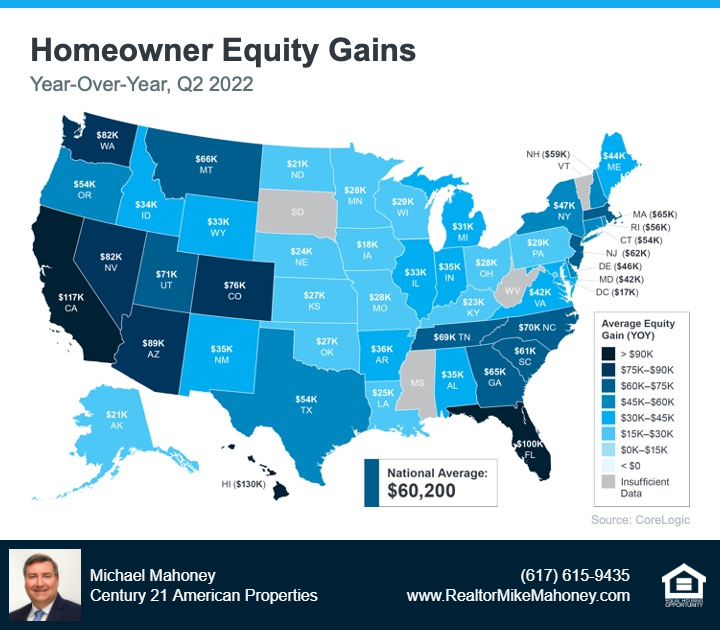

That’s why, according to the latest Homeowner Equity Insights from CoreLogic, the average homeowner equity has grown by $60,000 over the last 12 months. While that’s the national number, if you want to know what happened, on average, over the past year in your area, look at the map below from CoreLogic:

Where Experts Say Rates and Inflation Will Go from Here

Moving forward, both of these factors will continue to impact the housing market. A recent article from CNET puts the relationship between inflation and mortgage rates in simple terms:

“As a general rule, when inflation is low, mortgage rates tend to be lower. When inflation is high, rates tend to be higher.”

Sam Khater, Chief Economist at Freddie Mac, has this to say about where rates may go from here:

“Mortgage rates remained volatile due to the tug of war between inflationary pressures and a clear slowdown in economic growth. The high uncertainty surrounding inflation and other factors will likely cause rates to remain variable, . . .”

Bottom Line

Although there is volatility with mortgage rates and the stock market, but home equity and homeownership has always been a cornerstone in the creation of wealth in American.

|

About Realtor Michael Mahoney

About Realtor Michael Mahoney