The Average Homeowner Gained $56,700 in Equity over the Past Year

When you think of homeownership, what’s the first thing that comes to mind? Chances are you might focus on the non-financial benefits, like the security or stability a home provides. But what about equity? While it can be overlooked, a homeowner’s equity helps build long-term wealth over time. Here’s a look at what equity is and why it matters.

For a homeowner, your equity is the current value of your home minus what you owe on the loan. So, as home values climb, your equity does too. That’s exactly what’s happening today. There aren’t enough homes on the market to meet buyer demand, so bidding wars and multiple offers are driving prices up. That’s because people are willing to pay more to buy a home. Right now, this low supply and high demand are giving current homeowners a significant equity boost.

Dr. Frank Nothaft, Chief Economist at CoreLogic, explains it like this:

“Home price growth is the principal driver of home equity creation. The CoreLogic Home Price Index reported home prices were up 17.7% for the past 12 months ending September, spurring the record gains in home equity wealth.”

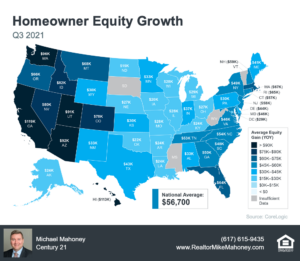

To find out just how much rising home values have impacted equity, we turn to the latest Homeowner Equity Insights from CoreLogic. According to that report, the average homeowner’s equity has grown by $56,700 over the last 12 months.

Curious how your state stacks up? Check out the map below to find out the average equity gain for your area.

How Rising Equity Impacts You

If you’re already a homeowner, equity not only builds your wealth, it also opens doors for you to achieve your goals. It works like this: when you sell your house, the equity you built up comes back to you in the sale. You can use those proceeds to fuel your next move, especially if you’ve decided your needs have changed and you’re looking for something new.

If you’re thinking about becoming a homeowner, understanding the importance of equity can help you realize why homeownership is a worthwhile goal. It builds your wealth and gives you peace of mind that your investment is a wise one, not just from a lifestyle perspective, but from a financial one too.

Bottom Line

Whether you’re a current homeowner or you’re ready to become one, it’s important to know how equity works and why it matters. If this inspires you to make a move, let’s connect to explore your options and find out what steps you need to take next.

Recent Blog Posts by Realtor Michael Mahoney

Why Waiting to Purchase a Home Will Cost You

Mortgage Rates Remain Relatively Flat

About Realtor Michael Mahoney

Michael Mahoney | Realtor® | 617-615-9435 | mike@mmahoney.com

I am Michael Mahoney, a full-time Realtor® in the Boston area affiliated with Century 21. I have been a Boston area Realtor® since late 2001.

It’s my mission to help people realize their form of the “American Dream” using homeownership, real estate wealth building, and real estate investment as cornerstone of their financial foundation.

I work in all price points. The majority of my business is repeat clients and the referral of clients from all over Eastern Massachusetts.

I view my role as the advisor who helps people go from the life they have to the life they dream about. I have sold everything from mobile homes to amazing estates. I have sold hundreds of homes in almost every town in Suffolk and Norfolk County. I also sell homes in Plymouth, Bristol and Middlesex Counties. When asked what my specialty is, I often joke and say “from section eights”.

Get the value of your home now

The information contained, and the opinions expressed, in this article are not intended to be construed as investment advice. Michael Mahoney, Realtor® does not guarantee or warrant the accuracy or completeness of the information or opinions contained herein. Nothing herein should be construed as investment advice. You should always conduct your own research and due diligence and obtain professional advice before making any investment decision. Michael Mahoney will not be liable for any loss or damage caused by your reliance on the information or opinions contained herein.